What is the impact of additional tariffs on China's PDH industry? How should it be addressed?

Recently, the United States has imposed additional tariffs globally and higher rates on specific trading partners. The tariff rates for China, Cambodia, Vietnam, and Myanmar are respectively 34%、49%、46% and 44% . If the previously imposed tariffs on China are included, the actual tariff rate for some Chinese goods may be as high as 20% tariffs. 54% . To counterbalance the US-China trade, China has implemented countermeasures, imposing additional tariffs on all imported goods originating from the United States. 34% tariffs.

In the US-China chemical trade market, propane is the largest chemical product imported by China from the United States, 2024 with total imports exceeding 2900 thousand tons annually, and import value exceeding 187 billion US dollars, ranking third among imports from the United States (by value). China is the world's largest PDH country, while the US shale gas industry has produced a large amount of propane as a byproduct. Currently, China's PDH companies are relatively reliant on US propane resources.

The imposition of equivalent tariffs may lead to different variables in different industries in the future, but judging from the figures, PDH how much will the cost increase for businesses? How should Chinese PDH companies respond?

1. The United States is China's largest importer of propane

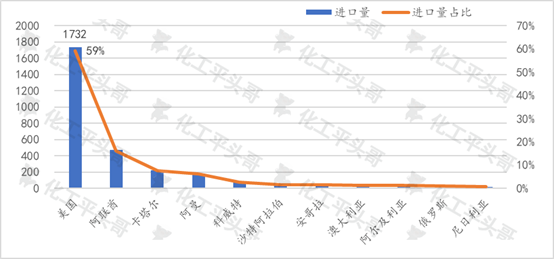

According to customs statistics, 2024 China imported a total of over 2900 thousand tons of propane, of which over 1700 thousand tons were imported from the United States, accounting for over 59% of total imports . Following are the Middle Eastern countries of the UAE, Qatar, Oman, Kuwait, and Saudi Arabia, with the UAE's imports at only 469 thousand tons. It can be said that the United States is the core country for China's propane imports, accounting for more than half of the share.

2024 The United States exported over 5000 thousand tons of propane, with over 33% flowing to China. It can also be said that China is the core country for US propane exports. If China imposes 34% tariffs on US propane, coupled with the previous tariff rate of 1% the total tariff rate at 35% will inevitably have a huge impact on the flow of US propane to China.

Figure 1 China 2024 Proportion of propane imports by country

2. The unit price of propane imported from the United States does not have a significant advantage

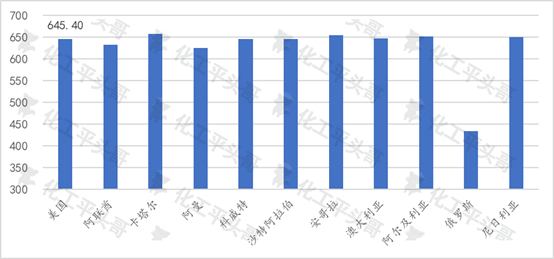

According to customs statistics, 2024 the unit price of propane imported by China from the United States was 645 US dollars / per ton. Calculated with the exchange rate, tariffs, and customs fees, the declared price in RMB is 5400 yuan / per ton. Considering 2024 China's propane imports from other countries, the average price of propane imported from the United States does not have a significant advantage. The average price of propane imported from Russia is the lowest, at only 433 US dollars / tons . The average price of propane imported from countries such as the UAE, Oman, Kuwait, Iraq, Thailand, and Kazakhstan is lower than the US price.

If based on the 2024 price of propane imported from the United States, with the current 35% tariff, the RMB price will increase to 7100 yuan / tons, an increase of approximately 32% compared to the normal tariff. From 2009 to 2025 month, 4 China's propane price has not exceeded 7000 yuan / tons, and imported propane exceeded 2013 tons in 7000 yuan / . In other words, if China imposes 35% import tariffs on propane from the United States, the price of imported propane is expected to instantly hit a record high.

Figure 2 Comparison of average prices of imported propane from different countries (USD /t )

3. Implementing equivalent tariffs, how will Chinese PDH companies' profits be affected?

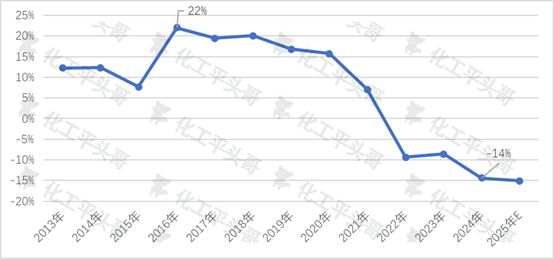

It is observed that China's PDH industry has been in a downturn for a considerable period. From 2013 to 2024 China's PDH theoretical profit margin remained slightly profitable, with the highest profit margin in 2016 reaching approximately 22% . From 2020 the profit margin began to decline sharply.

The key reason for the decline in the profitability of PDH facilities is the intense market competition and weak end-market demand. PDH There is severe homogeneity among downstream products, with the main downstream applications being polypropylene, followed by acrylic acid, 2-ethylhexanol, etc. However, PDH due to the large number of new projects, speculation on raw material propane has intensified, increasing the propane bubble and raising PDH companies' production costs.

Under the premise of implementing equivalent tariffs, PDH the delivered factory price of propane imported by 7100 yuan / companies will exceed PDH Companies will experience exceeding 46% losses 。

Figure 3 China PDH Theoretical profit margin fluctuation

Data Source: Shengyi She, General Administration of Customs

According to 2024 Under annual market conditions, based on the analysis of PDH The cost structure of the unit reveals that raw and auxiliary materials account for PDH of the total cost 85% This is the biggest cost influencing factor. Among them, propane accounts for 83% above the total cost, which is crucial for PDH unit profitability 。

Figure 4 PDH Unit Cost Structure

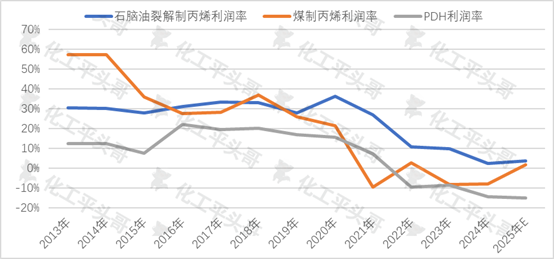

IV. Competitiveness of olefins under different processes, PDH The weakest

Based on steam cracking of naphtha, coal-to-olefins and PDH three olefin production processes, the profit margin level from 2013 to 2024 year was calculated, leading to the following conclusion: 1、 PDH This is the method among the three olefin production methods whose profit margin has maintained a relatively low level for a long time, and its competitiveness is weak. 2 The steam cracking of naphtha to produce olefins has the strongest competitiveness. If self-sufficiency of naphtha is considered, it will be even more competitive.

Olefins are the basic core of the petrochemical industry and are also key raw materials for industrial chain extension. The competitiveness of the olefin industry directly determines the competitiveness of enterprises. PDH This belongs to a method with relatively weak competitiveness in olefin production and cannot be compared with steam cracking of naphtha and coal-to-olefins. In addition, after the imposition of countervailing duties on US propane, the increase in costs is huge, PDH further weakening its competitiveness.

Figure 5 Profit Margin Fluctuation of Olefins under Different Processes

Data Source: Shengyi She

V. In the face of the China-US trade war, PDH How should companies save themselves?

It is believed that previously when the US fell ill, the whole world took medicine, but now when the US falls ill, the whole world is firing back. The China-US trade war has been fully launched, PDH The industry is a typical representative in the Chinese chemical market and is one of the most sensitive groups to import prices. In order to reduce the impact of this tariff war, PDH how should enterprises save themselves?

1 The inclusion of propane in the tariff list may be inevitable. It is suggested that PDH enterprises actively strive for exemption rights.

2 If imported US propane is processed to produce propylene, the processing with supplied materials model can be applied, and processing and production can be carried out in bonded areas. This requires PDH enterprises to actively expand overseas markets.

3、 PDH Enterprises should reduce production costs as much as possible to offset the increase in tariff costs, such as the reduction in wastewater treatment costs, which will bring PDH to enterprises 5%-6% reduction in processing costs, and the reduction in electricity costs may bring 10% reduction in processing costs.

4 It is necessary to quickly find non-US propane supplies, and the Middle East can be considered as a key source of propane. (From WeChat Official Account: Chemical Flat-headed Brother)